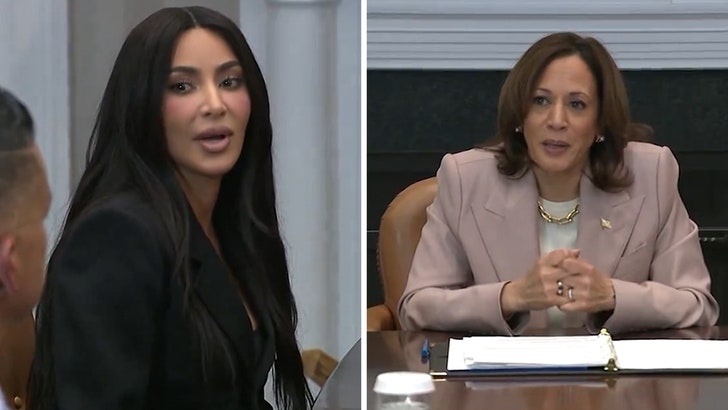

Kim Kardashian Back at White House For Criminal Justice Reform

Kim Kardashian went back to the White House to advocate for criminal justice reform -- only here, it was with Biden's camp ... proving she's loyal to the cause, and not to any party.

The reality star -- who has regularly used her platform to advocate for this -- met with Vice President Kamala Harris Thursday for a roundtable discussion after POTUS granted clemency to 16 people previously convicted of nonviolent drug offenses.

As Kim spoke with the Veep and some of the pardoned individuals, she made it clear her only agenda was to advocate for prison reform, no matter who's in office ... and she thanked the recently released subjects for sharing their stories and putting a spotlight on the issue.