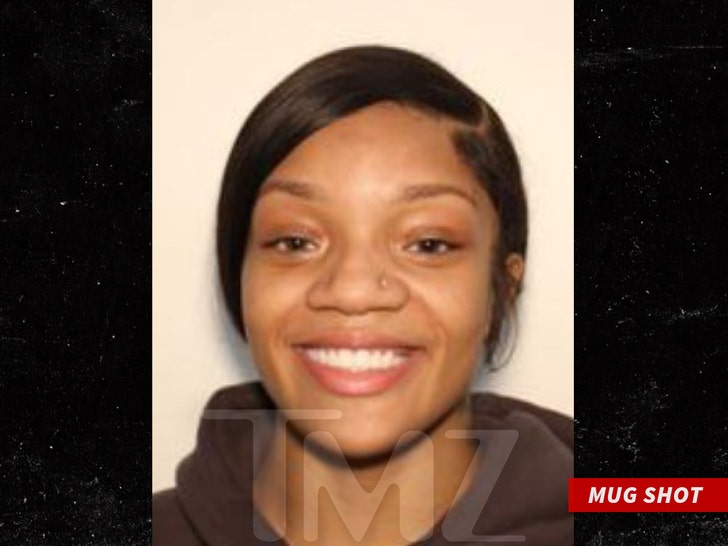

JENNA JAMESON WIFE JESSI TAKES DOWN 'DIVORCE' Vid ... Future Up In the Air

Jenna Jameson's estranged wife might be rethinking her approach to their uncoupling ... because she took down her tell-all "divorce" video for the sake of her ex's well-being.

Jessi Lawless tells TMZ she pulled the video down from her social media Wednesday after having a heart-to-heart phone call with Jenna. She says she understands Jenna's been catching heat online since Jessi posted it ... announcing she was filing to end their marriage.

04/16/24

04/16/24

She says, "I don’t want her mental health impacted any more than it already has been. I love her. This is a very delicate time for us. We’re both heartbroken and trying to find hope for the future."