Taylor Swift Blasted For Line About 1830s ... People Mocking, Pissed!!!

Taylor Swift's new album's already causing some controversy ... and, it ain't about an ex either -- it's all got to do with T-Swift's view of American history, including the ugly part. 😬

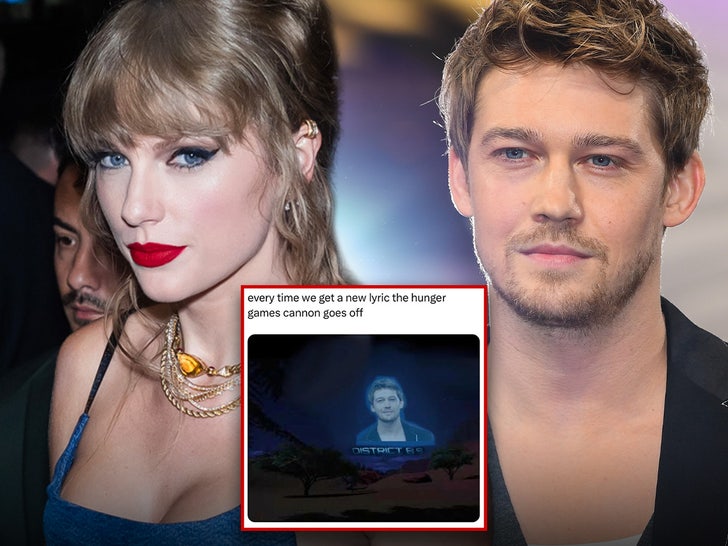

The singer dropped "The Tortured Poet's Department" Friday ... and, while many fans are jammin' out to the tunes and diving into hints about Matty Healy and Kim Kardashian -- others took aim at her song "I Hate It Here" ... which includes some eyebrow-raising lyrics.

In the song, Tay Tay sings, "My friends used to play a game where / We would pick a decade / We wished we could live in instead of this / I'd say the 1830s but without all the racists / And getting married off for the highest bid."